https://en.wikipedia.org/wiki/Interest#Simple_interest

https://en.wikipedia.org/wiki/Interest#Compound_interest

https://en.wikipedia.org/wiki/Volatility_(finance)

https://en.wikipedia.org/wiki/Perpetual_futures

https://en.wikipedia.org/wiki/Leverage_(finance)

https://en.wikipedia.org/wiki/Margin_(finance)#Margin_call

https://en.wikipedia.org/wiki/Liquidation_value

https://en.wikipedia.org/wiki/Option_(finance)

https://en.wikipedia.org/wiki/Collateralized_debt_obligation

https://en.wikipedia.org/wiki/Exchange-traded_fund

-

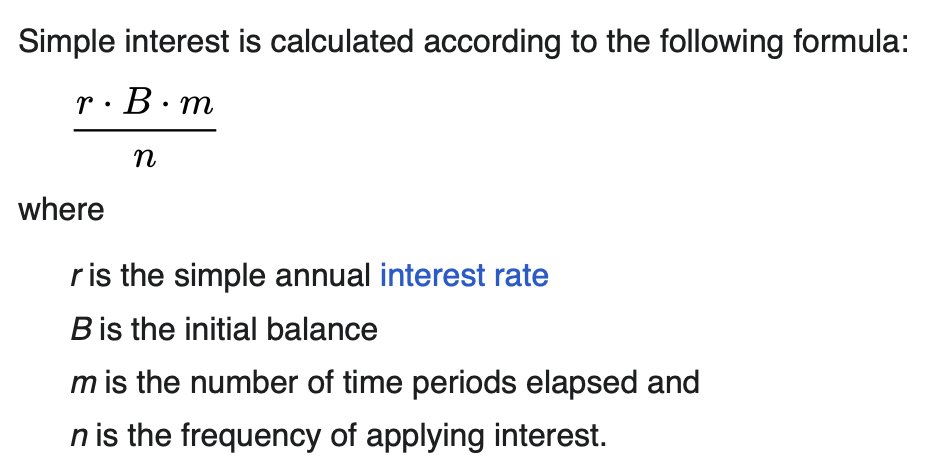

Simple Interest (단리)

-

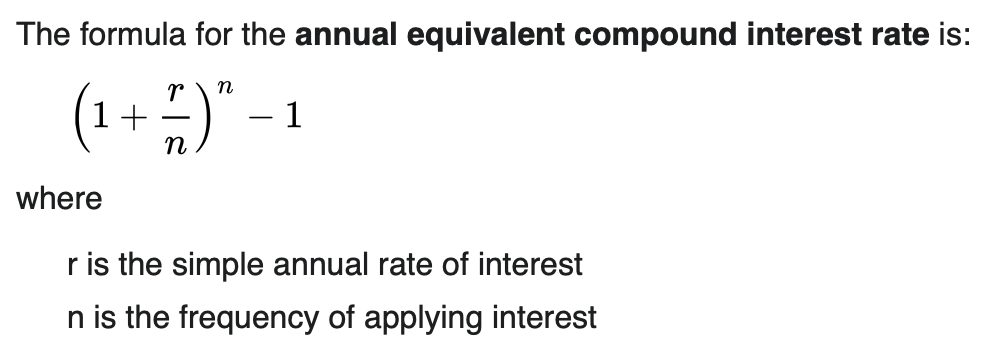

Compound Interest (복리)

-

Volatility (σ, sigma)

- the degree of variation of a trading price series over time, usually measured by the standard deviation of logarithmic returns

-

Futures contract (futures)

- a standardized legal contract to buy or sell something at a predetermined price for delivery at a specified time in the future, between parties not yet known to each other

-

Perpetual (perpetual futures contract, perpetual swap)

- an agreement to non-optionally buy or sell an asset at an unspecified point in the future

-

Leverage (gearing)

- any technique involving borrowing funds to buy an investment

- 투자 포지션의 크기를 더 크게 만들 수 있는 재정적 기법

-

Margin trading

-

자금을 빌려서 투자에 사용하는 거래 방식

- Taking a Position: 특정 자산을 보유하는 것

- Expanding a Position: 특정 자산을 기존에 더하여 추가로 보유하는 것

-

-

Margin Call

-

Liquidation

-

Options

-

Collateralized Debt Position

-

ETF

-

Commodities & Securities (상품 & 증권)

정의적 연관성

Commodities(상품): 물리적 자원이나 상품으로, 예를 들어 원유, 금속, 농산물 등이 포함됩니다. 이들은 시장에서 거래되며, 공급과 수요의 변동에 따라 가격이 결정됩니다.

Securities(증권): 주식, 채권, 파생상품과 같은 금융 자산을 말합니다. 이들은 회사나 정부 등이 발행하고, 시장에서 거래되며, 투자 수익을 추구하는 데 사용됩니다.

금융 시장에서의 상호작용

Commodities 거래: 상품은 물리적으로 존재하며, 그 가격은 공급과 수요에 의해 결정됩니다. 금융 시장에서는 상품 선물, 옵션 등의 파생상품을 통해 거래될 수 있습니다. 이는 가격 변동에 대한 리스크 관리나 투자 수익을 추구하는 도구로 사용됩니다.

Securities 거래: 증권은 금융 자산으로, 기업의 주식, 정부의 채권 등이 포함됩니다. 주식 시장에서는 주식을 매수하고 팔아 수익을 추구하며, 채권 시장에서는 안전한 수익을 얻기 위해 투자될 수 있습니다.

투자 및 리스크 관리

투자 전략: 투자자들은 자산 배분을 위해 상품과 증권을 조합하여 포트폴리오를 구성할 수 있습니다. 예를 들어, 상품은 인플레이션 대응, 다양한 자산 클래스를 통한 분산 투자를 위해 사용될 수 있습니다.

리스크 관리: 상품과 증권은 모두 리스크 관리의 도구로 사용될 수 있습니다. 상품 선물이나 옵션을 통해 특정 상품의 가격 변동으로부터 보호받을 수 있으며, 증권의 다양성을 통해 시장 리스크를 분산시킬 수 있습니다.

규제와 법적 측면

- 규제: 상품과 증권 모두 규제 당국의 감독을 받습니다. 금융 시장에서는 규제가 투자자 보호와 시장의 안정성을 유지하는 데 중요한 역할을 합니다.

- 법적 측면: 각각의 거래는 법적 계약과 규정에 따라 이루어집니다. 예를 들어, 상품 선물 거래는 거래소에서의 표준화된 계약에 의해 이루어지며, 증권 거래는 국가의 증권법과 규정에 따라 발행과 거래가 이루어집니다.